“The Times They Are A-Changin.” Yes, Mr. Dylan they certainly are. Bob Dylan recently sold his entire music collection of more than 600 songs for an estimated $300 million. Bruce Springsteen just sold his to Sony Music for an estimated $500 million. Musicians, artists, and creators are getting paid more than ever before for their hard work. While these artists are unmistakable legends in their field, the concept of selling one’s life’s work doesn’t only have to apply to the ultra-famous. For too long artists have had to wait for lighting to strike or wait until they are dead to make real money off their work. Van Gogh died only months after he sold his first and only painting for the equivalent of $78, even though his collection is now worth over an estimated $670 million. My guess is most artists would rather be in Springsteen’s category than Van Gogh’s. NFTs are changing the game for living artists but there are a few key points you need to know.

What are NFTs?

The term NFT stands for Non-Fungible Token. A non-interchangeable unit of data stored on a blockchain. This unit can be traded or sold for other NFTs or a designated crypto-currency, typically Etherium. The most common digital files associated with NFTs are photography, videos, animation, or audio. I am going to break down even this small paragraph into simpler terms.

– Non-Fungible Token – What is that? Think of it this way. A dollar is fungible. You can exchange it for another dollar and have something of the same value. Now, a mint condition Babe Ruth baseball card or a watch worn by Neil Armstrong when he first stepped on the moon is non-fungible. There are only one of those items. Realistically, it can’t be replaced by a similar item. Even if I gave you an authentic Omega Speedmaster it would not be Mr. Armstrong’s moon watch and it would certainly not be of equal value.

– Blockchain – A blockchain is a form of digital ledger. Think of it this way- when you buy a house, a copy of the deed is kept by your city to verify you are the owner of your house. Another person can’t come up and claim ownership of your house. If they do, the argument can quickly be dissolved by checking the ledger and seeing your information on the deed, not the jerk trying to claim your house. The blockchain says you are the rightful owner of your NFTs.

– Cryptocurrency – The most basic definition is a digital representation of value only available in electronic form. They are only accessed, traded, transacted, or stored in specialized applications. Moving cryptocurrency from one owner to another must go through designated networks or over the internet. Bitcoin and Etherium are the two most common cryptocurrencies traded in today’s market. However, in today’s NFT world, the most used form of currency is Ethereum trading at $3,002.22 per unit, as of 3:48 PM CST on March 22, 2022. Like any traded good such as stock or gold, this value rises and falls due to market demand. According to Investopedia, As of March 2022, there are currently over 18,000 different types of cryptocurrency.

Types of cryptocurrency or virtual currency

– Closed – this type operates and is managed in a closed environment. It cannot be converted into anything else. It is a “one for one” system typically used by gamers for in-game transactions. Airline Miles and certain credit card point systems are also examples of closed virtual currency.

– Open – also known as convertible virtual currency and as the name suggests can be converted into other currencies such as dollars or anything the system allows.

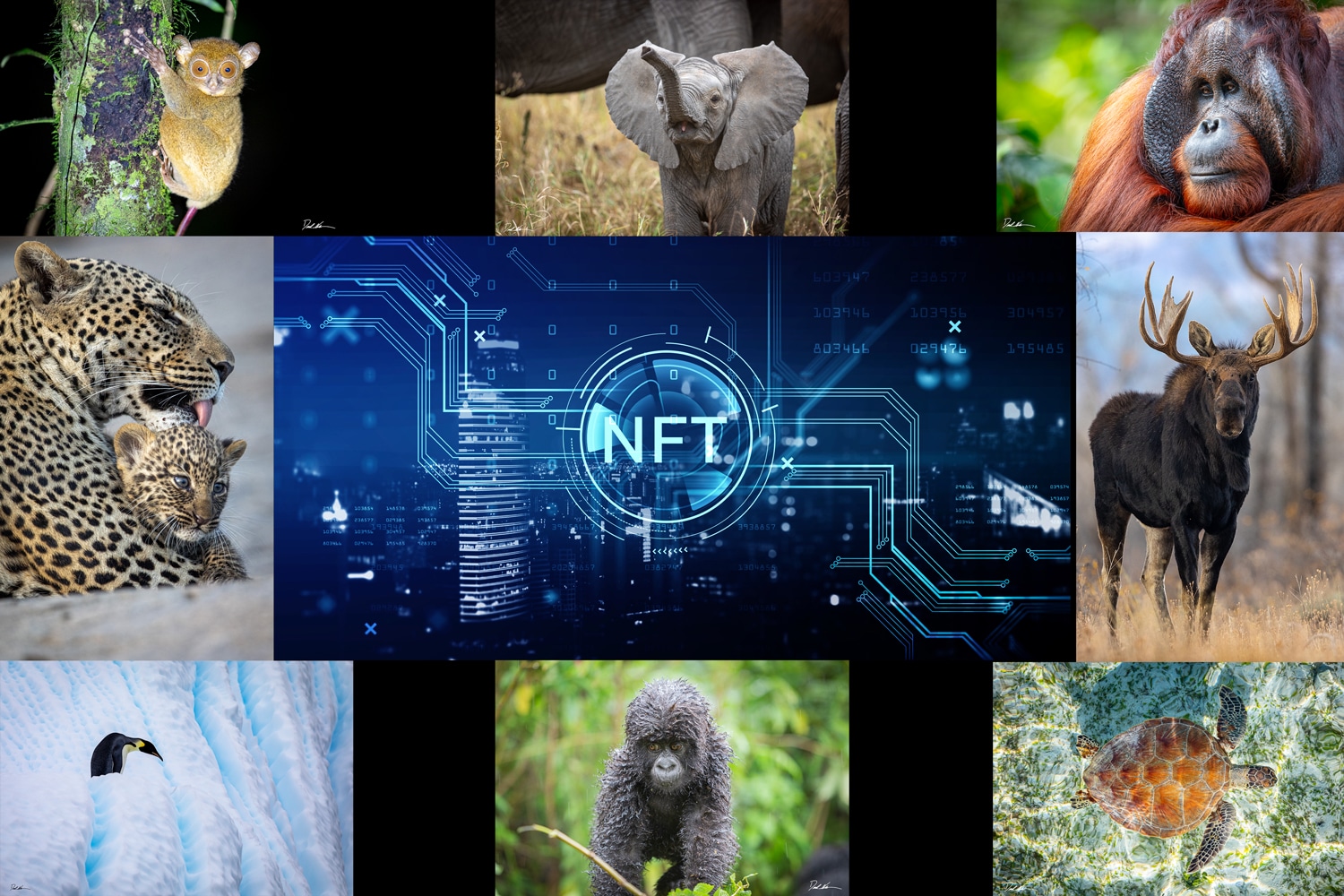

Photography and NFTs

(Mr. Mischievous available as a limited edition luxury fine art print or NFT)

In today’s photography, NFTs are the original digital files of an image. 1 of 1. This is the final product from capture through production and editing. The sole file an ethical artist would use to share their work with the world. Photography, for example, can be sold as an edition to create exclusivity. The artist would take that single finalized digital file and send it off to a printer for the production of prints. Let’s say 1 of 100 of a particular image. Number 1 in that edition carries the most value and possibly number 100 second in value because it is the last. Artists go one step further by offering an Artist Proof. Until NFTs came around, Artist Proofs were the most exclusive offering an artist could provide. An NFT is essentially selling the ownership of the image without providing a digital file in the form of a contract. I’ll get into more of the copyright language later. Here are some frequently asked questions about photography and NFTs

Photography NFT FAQs

What Makes An NFT Valuable?

The value of an NFT lies in the item it represents. In this case digital art. The “deed” to this digital art lies on the blockchain. The NFT itself isn’t a valuable item but it points to the location it’s stored. Like in today’s ticketing world, when you purchase a ticket to a sporting event or concert, you receive an email with a digital confirmation or “deed”. The email containing the confirmation is like the NFT. It leads to your confirmation. This confirmation is digitally scanned leading to your asset “seat” or “house”. If the concert sells out you can then resell your ticket for a higher value on the market. When someone mints a collection of NFTs the more popular they become the higher the value of the items is. When they sell out, just like a concert, the aftermarket value can increase.

Are NFTs The Future Of Art?

It certainly depends on who you ask. Photographers and other digital artists like it because it’s another way to make a sale. Artists can now reach broader audiences not previously associated with the art world. With today’s planet becoming more and more digital, not even mentioning the Metaverse, it only makes sense art will be expanding further into the digital space. Art has been a keystone to every civilization and society from the dawn of humankind. Art will undoubtedly be a part of the digital societies to come.

How Do You Make A NFT?

First, you’ll need to create an account with a crypto exchange. I chose Coinbase simply because it was said to be among the top-rated and one of the easiest to use for beginners. Other popular exchanges are Biance.us, Crypto.com, Kraken, and Gemini.

Next, now that you have an exchange account, you will need to add some funds to this account via fiat currency aka real money. Dollars, Euros, etc. In the exchange, you can buy all types of cryptocurrencies. For NFTs though, you will need Ethereum (ETH).

The next step is a little confusing. You will need to get a digital wallet. Again, because of its simplicity, I went with the Coinbase wallet and it made sense because I had a Coinbase exchange account. Funds from your exchange account need to be transferred to your electronic wallet to pay for registration and gas fees charged by hosting sites (marketplaces) to list your NFTs.

Finally, once you have added money to your wallet you may upload your digital file aka “minting” by paying for registration or gas fees to list your item for sale on the open market. Once you get a feel for how this operation works it’s fairly simple to mint several images or even make collections for sale. Below is a list of the most popular marketplaces.

Popular NFT marketplaces are

OpenSea – Arguably the most popular marketplace. This platform certainly has the most options when it comes to digital offerings. It is very easy to use, browse and get started as a creator. They now offer free minting but change fees after the NFT is sold.

Rariable – Like OpenSea all kinds of digital offerings can be found on Rariable including music, videos, and collectibles. They use their currency however called a $RARI. This particular token will be distributed to sellers a week after the sale based on the volume sold.

SuperRare – SuperRare is an art-first marketplace placing artistic intent above meme content. They are an invitation-only platform so it kind of functions as an elite art gallery. NFTs are curated attempting to only offer highly interesting works.

Nifty Gateway – This is the place where two of the biggest $$$$ have been sold. Beeple’s CROSSROAD and Pak’s The Merge, which sold for US$91.8 million in December 2021. This platform allows collectors to purchase NFTs using government-issued currency so you can use a credit or debit card. So if you don’t want to go the whole crypto wallet route this is the best platform for you.

Foundation – Like SuperRare, Foundation is an invite-only marketplace. The artist takes home 85% of the sale and 10% on secondary sales. NFTs tend to sell a little higher on Foundation. Creations on here are curated and tend to be more authentic and artistic.

What Price Should I Set For My NFT?

This can go any direction you want. “The average selling price of a nonfungible token has declined to under $2,000, compared with an all-time high of almost $6,900 on Jan. 2, according to industry data tracker NonFungible.” Olga Kharif Bloomberg writes. Meanwhile, as mentioned above, the most expensive NFT of all time sold for a staggering $91.8 million. The artist Pak created “The Merge” and sold the piece on 12/2/21 to a collection of 30,000 investors. In the end, you should ask what you think your art is worth. Shooting for the moon may leave you right where you started with a digital asset and no money for it. Or…..it could sell for an amount that changes your life.

What Can NFTs Be Used For?

NFTs can be used essentially as digital collector’s items. It’s kind of like asking “what can baseball cards be used for?” or “what can autographed memorabilia be used for?”. These are all collector’s items that make the collector happy with a perceived value to a set of individuals. NFTs can be pretty, psychedelic, thought-provoking, or absolutely none of the above. What matters most is someone finds value in it. They are traded and sold just like any other collector’s items. The more rare or trendy the digital asset the more expensive typically. Supply vs. Demand. There is a dark side to what NFTs are used for but I will dive into that further in the article.

Why Are NFTs Popular?

As the world becomes more digital so too are our ways to interact with each other. Anyone willing to pay can own a part of history (Jack Dorsey’s first tweet $2.9million) or gain a connection to a favorite celebrity or artist. The rapper Snoop Dog has been one of the NFT industry’s biggest supporters. Artists and creators like them because it is another way to create revenue, engage with fans, and retain royalties for their work. Musicians have creatively woven lifetime admission to their shows for the purchase of their NFTs while photographers have rewarded the auction winner with a physical print.

Are NFTs Here To Stay?

As long as people are continuing to be creative, yes. In a recent tweet by @nogoodlogan on Twitter. They share this hysterical image of a collection of Forbes headlines.

The fact is no one knows. NFTs are more than just the latest fad of collectibles though that end up costing parents lots of money that their kids end up cramming in a box in an attic. Because they are diverse enough, NFTs aren’t going anywhere.

Should You Buy NFTs?

Any investment has risk. Gold, one of the most stable investments in the history of humankind, has a risk to it. The most important thing about any investment is you should only involve as much as you can afford to lose. Because NFTs have very little trading history to judge their performance, a particular NFT could go either direction. In a way, you are investing in the artist’s personal stock. Say an artist is on track to become the most famous digital artist of all time, and you feel confident an NFT worth $20,000 will only increase in the next year. So, you buy it. Four days later the artist goes on some racist rampage caught on camera that quickly spreads across YouTube. That sure thing of a $20,000 investment is now worth pennies because no one wants to be associated with that artist. It happens all the time. Elon Musk smoked weed on a podcast causing Tesla’s stock to drop 9%.

“That short-lived plan has triggered an SEC investigation, as well as at least two lawsuits filed by short-sellers who claim it resulted in losses of hundreds of millions of dollars.” NBC News.

It may pay to do a little digging into your investment before you decide to bet the house on them. Remember, an NFT’s value is only what someone else will pay for it.

How Do I Resell An NFT?

Ok, so now you have purchased an NFT. The artist is behaving and exceeding all popularity expectations. Time to cash in. Right? If you wish. Through the same exchange, you purchased the NFT you can create your sale. Your NFT was most likely stored in your account on the exchange or transferred to your digital wallet. Simply hit “Sell” then set the terms of the auction. Gas fees, listing fees, and any royalties the original creator set will be taken from the final payout. I’ll dive into this more but it’s worth noting here as well: any profit made from the sale of an NFT is subject to capital gains taxes. This is no different from when you sell as stock and should be considered the same.

What Are NFT Smart Contracts?

Smart contracts are essentially the original agreement the creator of an NFT decides to put on the sale of the NFT stored in the blockchain (ledger) and the percentage of royalties received for every sale going forward. They represent ownership of the asset along with any built-in license agreements but are not copyright. Copyright remains with the artist unless it specifically says so in the contract. Think of any contract used in business, like when you purchased your house or bought a car from a dealership. The contract is filled with endless fees and commissions to protect both the buyer and the seller. A smart contract eliminates the need for lawyers, agents, credit checks and the list goes on. It is a quick transaction between the bank, the buyer, and the seller. They are discrete, hard to hack, quick to execute, and cost-effective.

Are NFTs Taxed?

Yes, they are subject to the same tax laws as fungible currencies like Bitcoin or Ethereum. If you make money as an artist or as a collector you have to pay capital gains tax.

NFTs are taxed when

– They are sold for cryptocurrency

– One is purchased with cryptocurrency

– Traded for another NFT

Strap in this is where it gets interesting. If you sell an NFT it will be taxed at your personal income rate (see table below for U.S. tax rates). If you purchase an NFT with appreciated cryptocurrency, the token is now worth more than when you bought it, you would need to pay a capital gain. However, if you bought an NFT with depreciated cryptocurrency you would experience a capital loss. This could offset your other capital gains and decrease your tax liability.

It gets better…

Selling An NFT For Cryptocurrency – Just like selling a stock. If you purchased an NFT and the price goes up. The taxable portion of your sale is your profit or capital gain. If you sell it for less than when you bought it, it is your loss or a capital loss.

Trading One NFT For Another NFT – also can be taxed. Let’s say you buy an NFT for 1 ETH $3,021 (3/23/22) and you later trade that same NFT for another worth 2 ETH $6,042 your capital gain on the transaction would be 1 ETH or $3,021.

Wait, not finished yet…..

If you decide to purchase an NFT and hold on to it for the long haul of this investment you move into the long-term capital gain category for anything over 366 days and your tax rate becomes somewhere between 0-20% based on your tax rate.

If you decide to short sell it, anything less than 365 days will be taxed per your normal income.

NFTs: The Pros and Cons

I know this is a lot of information, so let’s boil down the pros and cons of this emerging industry.

PROS

– Direct connection with an audience for an artist- A photographer from Gilberts, Illinois can sell art to a collector in Tokyo.

– Efficient safe transactions- Blockchain technology makes it impossible to hack or alter.

– Additional revenue for an artist- Digital artists have an additional way of making money outside of print sales or licensing.

– Allow artists to collect royalties on their work- Artists can build into their smart contract a way to make a % of every sale of that item going forward.

– Build a sense of community- Large communities of creators and collectors are forming on Twitter and in the Metaverse.

– Allow for fractionalizing of assets- multiple investors can buy one piece. It is challenging to divide a physical asset like jewelry, a house, or a car among multiple investors. Digital assets are quite easy.

– Provide diversification to an investment portfolio- The basic principle of not putting all your eggs in one basket. This allows investors to spread out their investments even further.

CONS

The cons are what kept me from getting into the NFT market until recently. I have transformed my entire photography career into working to protect the environment while keeping a high code of ethics. I live my life actively trying to preserve this planet. Even my NFTs are being sold to help environmental organizations. I am optimistic more energy-efficient practices will be available for this relatively new technology. Below are the three biggest CONS for NFTs and I’ll dive into each a little deeper.

NFTs Are Bad For The Environment

Whether you believe in global warming or not, most people acknowledge adding more carbon into the atmosphere is a bad thing. Some estimates are that the amount of energy used to create and store cryptocurrencies used to buy and sell NFTs releases millions of tons of carbon into the atmosphere. Cryptocurrencies and blockchains are designed to be impossible to destroy. “To keep financial records secure, the system forces people to solve complex puzzles using energy-guzzling machines. Solving the puzzles lets users, or “miners,” add a new “block” of verified transactions to a decentralized ledger called the blockchain.” says Justine Calma of TheVerge.com

Not to get too crazy technical, the current system for Ethereum is something called “proof of work.” This is the energy-devouring system described earlier that protects the records incredibly well. An alternative system is called “proof of stake”. This system is incredibly efficient and is what most artists, including myself, are hoping Ethereum switches to E2 (Ethereum 2.0). Basically, with the flip of a switch, the carbon footprint would drop to zero and most users would never know the difference. This would require a large systemic change though as everyone using Ethereum would need to change to E2 and of course, those are never easy or go as smooth as planned.

There are so many counterarguments to the potential offsets to cryptocurrencies being used for these NFT transactions and alternatives are available. Another alternative argument is that the cost of not having to ship art around the world, heat, light, and staff a gallery offsets the carbon footprint an artist might have contributed to had they had a physical space. The old way we viewed luxury fine art photography may be a dying pastime with rising rental costs, low return on investment for the artist, and the growing popularity of an online business.

Cryptocurrency And NFTs Art Safe Havens For Criminals

Ethical blow number 2. With the world on the verge of war as Russia continues to attack Ukraine, a notable location for wealthy Russians to hide their money from sanctions has been the unregulated cryptocurrency markets, including NFTs. While not completely being compared to “blood diamonds” forged from slave labor in Africa, one could argue cryptocurrencies are not helping Ukrainians fight for their freedom. Outside of donating them directly to the Ukrainians, cryptocurrencies have taken some of the financial stress off the imposed global sanctions by foreign governments.

As an artist and someone who believes in life, liberty, and the pursuit of happiness, I would not currently sell my art to anyone in Russia involved in the war against Ukraine. Through NFTs, I have no control over who buys my art or not. Often, it’s an anonymous handle. There is no face on the other side. No hand to shake or thank you is exchanged. It’s simply a bank transaction in many ways.

Beyond acting as a place for criminals to store their money, many artists have had their artwork listed on exchanges without their consent. This is a big problem. With copyright, an artist can point directly at the misuse of their work and sue for compensation. On a blockchain, if even discovered at all, a thief can take a screenshot of the original image from the artist’s website or social media. Place this fake reproduction on an exchange and sell it as the original. One of the best ways to avoid this is to complete transactions with verified accounts on exchanges that have human-moderated verification systems.

NFTs Are Not Good Investments Across The Board

When you invest your money in real estate or mutual funds, a typical steady growth can be assumed by any standard of the imagination regardless of where the investment is (obviously extreme locations or funds may differ). But the idea that an NFT will steadily increase over time is simply not true. They are collectibles. They depend on price appreciation which is not something you as an investor can depend on. Remember, if your artist becomes popular you may see a good return on investment. If they turn out to be a jerk or nothing or even a fraud then not so great of an investment. Your NFTs are only as valuable as someone is willing to pay for them.

Final Thoughts On NFTs

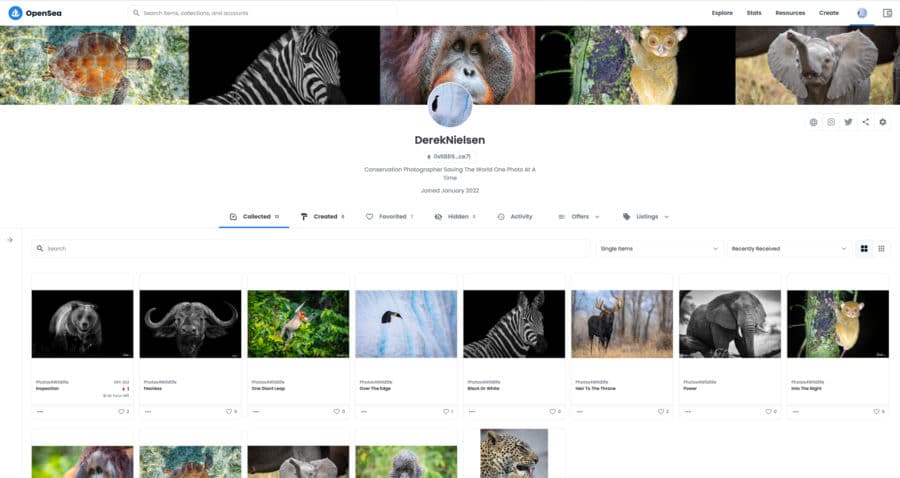

(Open Sea Exchange Page For Derek Nielsen Photography Wildlife Images)

By the time you reach this point in the article, I hope your head isn’t spinning and you have a better understanding of NFTs. If nothing else NFTs are certainly on the rise in popularity. They have the power to change the way we conduct business, interact with each other and how we buy, sell, and trade art. Yes, they have some serious concerns, however, I feel the pros outweigh the cons currently. As with any social technology or investing it is wise to use your best judgment. Do your research. If something seems too good to be true it probably is.

As an artist, I feel optimistic about the future of NFTs. For the first time in history, artists are being paid royalty for future sales. NFTs open up the reach for artists igniting a level of creativity the internet has never seen before. To this point, most people will still give you that blank stare or roll their eyes when you mention NFTs. But remember…for better or worse…

In 2004 Facebook went from 0 to 1 million registered users. In 3 years it reached 350 million users. Now there are 2.9 billion registered users. Just because something is new, scary, and confusing doesn’t mean it’s bad. While current artists like Taylor Swift or Kings of Leon are seriously diving into the NFT markets the potential and success of my friend, as Bob Dylan says, may just be blowing in the wind.

Written By – Derek Nielsen

Hello! I'm Derek.

DEREK NIELSEN PHOTOGRAPHY RAISES AWARENESS ABOUT THE GLOBAL NEED FOR CONSERVATION THROUGH PHOTOGRAPHY AND DONATES UP TO 15% OF ALL SALES BACK TO ENVIRONMENTAL ORGANIZATIONS AROUND THE WORLD.